RBI will shortly issue Rs 50 notes with the motif of Hampi with Chariot.

RBI will shortly issue Rs 50 notes with the motif of Hampi with Chariot.

RBI to release new fluorescent blue Rs 50 notes with motif of Hampi with Chariot

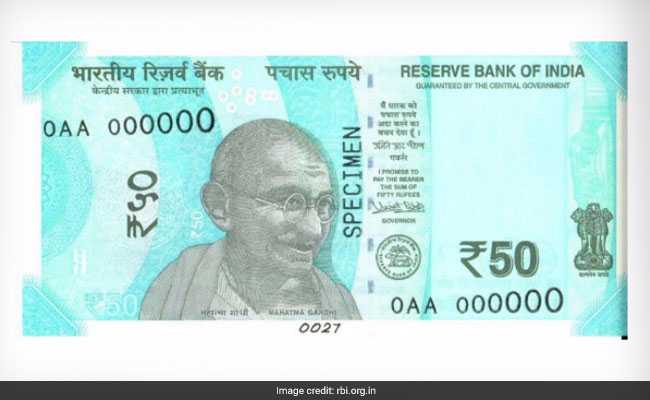

Mumbai: The Reserve Bank will soon introduce new fluorescent blue Rs 50 banknotes bearing the motif of ‘Hampi with Chariot’ that depicts India’s cultural background.

RBI said it’ll shortly issue these Rs 50 denomination banknotes inside the Mahatma Gandhi (new) series.

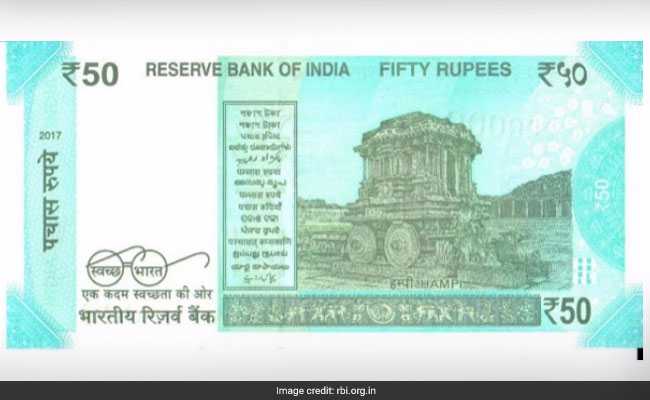

“The new denomination has the motif of Hampi with Chariot on the reverse, depicting the united states of America’s cultural heritage. The base colour of the notice is fluorescent blue,” RBI stated in a release.

Image Source NDTV

Among others, the brand new notes can have designs and geometric patterns aligning with the overall colour schemes, each on the obverse and opposite, it delivered.

On the obverse/front facet, the observer may have a portrait of Mahatma Gandhi on the centre, the denominational value in Devanagari script, micro letters RBI, India — each in English and Devanagari — as well as the numeral “50”.

The Ashoka pillar brand may be on the right aspect of the obverse and an electrotype watermark and the quantity panel with numerals in ascending order at the pinnacle left side and back side right aspect.

Image Source NDTV.

The new be aware having measurement of 66 mm X a hundred thirty-five mm will undergo the yr of printing at the opposite aspect, a Swachh Bharat emblem with the slogan, language panel and the motif of ‘Hampi with Chariot’.

“All the banknotes inside the denomination of Rs 50 issued by means of the Reserve Bank in the earlier collection will continue to be legal soft,” RBI delivered.

Edited By articlesworldbank.com