Business

Forbes billionaires list 2018, Mukesh Ambani placed in the 19th position.

Forbes billionaires list 2018, Mukesh Ambani placed in the 19th position.

Forbes billionaires listing 2018: Amazon's Bezos richest, Mukesh Ambani ranked 19

With a fortune really worth $a hundred and ten billion, Amazon founder Jeff Bezos is the world's richest guy and tops a 2018 Forbes Magazine list of billionaires.

Bezos is "the first character to pinnacle $100 billion as number one in the Forbes list of the World's Billionaires," the mag said.

Philanthopist and Microsoft founder Bill Gates is second ($90 billion), investment guru Warren Buffet third ($84 billion), Bernard Arnault and own family fourth ($72 billion), and Facebook founder-CEO Mark Zuckerberg 5th ($71 billion).

US President Donald Trump is valued at $three.1 billion.

Indian enterprise titan Mukesh Ambani, the chairman of Reliance Industries Limited, is nineteenth at the listing. He's valued at $40.1 billion.

Image Source IBTimes

Ambani turned into ranked 20th remaining yr. His wealth has grown with the aid of over eight billion greenbacks.

The different Indians (this consists of people of Indian starting place) on the list include:

The Hinduja own family ($19.Five billion)

Wipro Chairman Azim Premji ($18.Eight billion)

Steel multi-millionaire Lakshmi Mittal ($18.5 billion)

HCL founder Shiv Nadar ($14.6 billion)

Sun Pharma founder Dilip Shanghvi ($12.8 billion)

Aditya Birla Group Chairman Kumar Birla ($11.Eight billion)

Kotak Mahindra Executive Vice-Chairman and MD Uday Kotak ($10.7 billion)

Investor Radhakishan Dhamani ($10 billion)

Serum Institute of India founder Cyrus Poonawalla ($nine.1 billion)

Savitri Jindal and family ($8.8 billion)

Sunil Mittal and own family ($eight.8 billion)

Patanjali CEO Acharya Balkrishna ($6.3 billion)

Eicher Motors CEO Vikram Lal ($6.Three billion)

Wadia Group Chairman Nusli Wadia ($6.2 billion)

Shree Cement chairman Benu Gopal Bangur ($6 billion)

Amavardhan Motherson Group leader Vivek Chaand Sehgal ($6 billion)

Media baron Kalanithi Maran ($5.2 billion)

Essel Group Chairman Subhash Chandra ($5 billion)

Cadila Healthcare Chairman Pankaj Patel ($five billion)

LuLu Group International Chairman and MD MA Yusuff Ali ($ five billion)

Piramal Group leader Ajay Piramal ($4.Nine billion)

Bajaj Group's Niraj, Madhur and Shekhar Bajaj ($four.Eight billion)

MAJORITY OF BILLIONAIRES MEN

The Forbes list becomes dominated with the aid of male public figures. In fact, all the top ten billionaires have been guys.

With a fortune of $ forty-six billion, Alice Walton, the American heiress to the Walmart empire, is the best-ranked female (16th) within the listing. Others include L'Oréal chief Francoise Bettencourt Meyers, BMW co-proprietor Susanne Klatten, and Mars co-proprietor Jacqueline Mars.

With Input From India today

Read more

How GST Framework Can Help Their to Create Businesses in Technology Solutions

How GST Framework Can Help Their to Create Businesses in Technology Solutions

The Goods and Services Tax (GST) framework delivered by using the Government is embedded inside the best concepts of generation enabled tax management systems. In effect, primary to the administration, compliance, and evaluation of GST for taxpayers is the operation of the Goods and Services Tax Network (GSTN) that is installed region. Based on unconfirmed records it's miles predicted that details of greater than three billion invoices in line with month, from 10 million taxpayers would be uploaded. This parent is similarly expected to develop with the unorganized quarter getting into the tax framework.

Image Source business world

GSTN despite its strong framework is extensively supposed to be not able to accept this sort of a huge load of transactions. Thus, GST Suvidha Providers (GSPs) are granted licenses to interface with GSTN and proportion the load. GSPs shall provide interface thru which companies can speak with GSTN. Such interface is thru a software program which is being known as an Application Software Platform (ASP) solution.

Image Source GST ready India

The taxpayer network is carefully looking such tendencies with elevated concern. While big taxpayers (which includes MNC businesses, big cap Indian corporations, banks, and so forth) can also have already created an ERP spine thru which transaction facts can be captured, organised and uploaded the use of the ASP-GSP interface, many taxpayers within the mid-cap to SME sectors are not fully aligned to digitally record their commercial enterprise transactions. In those instances, compliances beneath GST thru uploading of transaction level records to the GSTN portal could be a totally complicated undertaking.

Image Source Forbes India

Technology solutions are already getting developed and presented in the marketplace to make sure that such taxpayers are given considered necessary assist to digitally file enterprise transaction degree records through the GSTN portal. It is going without pronouncing that failure to add GST returns with the transaction stage statistics might result in tremendous cash waft issues as clients of defaulting taxpayers may not be capable of claim or make use of their GST credits to lessen output GST liabilities resulting from a mismatch in buy as opposed to income transaction facts lines.

Image Source satiitv

Thus, era answers are urgently needed to cope with the subsequent problems (a) converting manual or non-digital transaction entries right into a virtual database (b) where digitised facts is available, standardise statistics line objects to make certain the equal can be auto-populated within the GST returns (c) construct interfaces (together with the ASP-GSP solutions) to immediately add GST returns into the GSTN portal and (d) create reviews/ interfaces that could deal with any mismatches of transaction stage statistics irregularities to facilitate smooth waft of GST credits among a set of taxpayers in a transaction chain.

Image Source gstkeeper

Innovation in era and integration of artificial intelligence has the capacity to minimise human intervention in the GST regime. Coupled with concern count knowledge in indirect taxation and techno-functional publicity to commercial enterprise eventualities, several consulting and IT firms (along with outs) have designed answers to help businesses with their whole set of GST returns overlaying compliance in addition to associated regions of vendor reconciliation, ledgers, inter-organization transaction credit and refund processing.

Image Source Pinterest

Eventually, above technology answers would evolve and begin growing “cost added” services or automated answers that could allow better levels of facts standardization and automated compliances. This fashion may additionally, at its intense, allow India corporations to reap a global-class oblique tax compliance framework in which each purchase or sale transaction is reconciled among respective returns of the customer and dealer, main to reduced leakages and more efficient tax management mechanism.

Image Source exactgst

However, till such time our united states of America evolves into such international-elegance compliance requirements, it's should structurally exchange the way wherein it information and disseminates commercial enterprise transactions with a view to attaining harmonious glide of GST credits within the transaction chain.

(The creator of this article is Amit Sarkar, head of the Indirect Tax exercise at BDO India. He is actively concerned in GST coverage formula and advocacy with the policymakers representing diverse industry institutions and chambers.)

Source: Businessworld

Edited By articlesworldbank.com

Read more

What Is Goods and Services Tax, An Overview

What Is Goods and Services Tax, An Overview

The Goods and Services Tax (G.S.T.) is a landmark step taken via the Government of India to enhance the GDP and introduce a greater powerful tax regime.

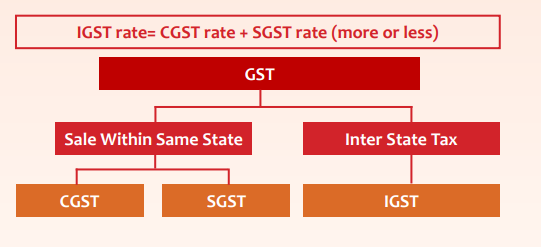

GST is a win-win scenario for the entire country. It brings benefits to all the stakeholders of the industry, government and the purchaser. It will lower the cost of goods and offerings to present a lift to the financial system and make the goods and services globally competitive. By subsuming most of the primary and country taxes into an unmarried tax and through allowing a set-off of prior-degree taxes for the transactions across the whole feed chain, it would mitigate the sick results of cascading and enhance competitiveness and liquidity of the agencies.

Image Source ClearIAS

GST could be applicable to all sellers whose combination turnover in a monetary 12 months exceeds INR 2.00 Million (INR 1.00 Million in case of 11 unique class states). Separate registration could be required in each kingdom from in which a taxable delivery of products or services is made.

This article covers a number of the unusual provisions of GST having an essential impact on the enterprise and gives an insightful attitude regarding the identical.

Image Source accounts4tutorials

Reverse Charge:

If the provider is not registered underneath GST and is providing taxable goods or offerings to a recipient who's registered, the GST on such taxable elements shall be borne by means of the recipient on opposite price foundation. Meaning registration appears to be obligatory for each birthday party; else it's miles pretty possible that due to greater compliance troubles human beings is probably inquisitive about doing commercial enterprise most effective with the one's events who're registered under the GST rules. With few days left with GST entering force, this registration parameter may create a large time trouble among small dealer’s as they could lose some commercial enterprise till they get registered underneath GST. Thus, on the way to counter this trouble, an economic threshold restriction in location will act as a cushion for such small business homes until the time they come completely underneath the ambit of GST compliance.

Image Source aagst

Ratings:

The authorities will supply a web rating on level, timeliness, and performance of compliances. Non-compliance will no longer just cause consequences however also blacklisting, which can have an effect on the destiny creditability, popularity and may harm the commercial enterprise boom of a commercial enterprise.

This online rating is going to be to be had at the net portal and you'll be able to check and determine enterprise associations on the premise of these rankings.

GST on Stock Transfer:

GST is chargeable on stock transfers to depots and stockists. This will further grow the running capital requirement as the suppliers ought to incur value on the switch of goods to very own godowns and depots with none actual revenue getting gathered or realized.

The GST paid in one of these cases may be claimed as entering tax credit score on the sale of goods from depots or warehouses.

Image Source LinkedIn

Area Based Exemptions:

Under the present day tax laws North East, Uttarakhand and Himachal Pradesh have positive regions exempted from excise responsibility and other country taxes. Department of Industrial Policy and Promotion is working on a scheme in which organizations will have to pay tax in advance and may claim a refund of the identical in the areas said above. Taxes paid additionally can be claimed as prompt in opposition to any legal responsibility. The enterprise needs readability on policy and time for adjustment. It is eager on availing clean and hassles unfastened refunds.

Free of Cost Supply as Sample/Gifts/Promotional Schemes:

Free samples and gifts supplied with purchases in addition to popular ‘purchase-one-get-one-unfastened’ deals may attract GST.

GST could be totally primarily based on the concept of a ‘supply’, which now consists of even goods and/ or offerings furnished without consideration by a taxable character within the course of or furtherance of the enterprise. This will affect the income and advertising and marketing price of agencies which follow such schemes. Buyers will pay GST on articles they get hold of unfastened.

Image Source pteducation

Presently, for a unfastened sample of products, excise responsibility is payable however VAT/ CST isn't always payable. However, proportionate input tax credit below VAT is reversible in some states. The internet impact for groups will consequently be the distinction between the prevailing excise and VAT cost, and the GST which will become payable.

Now again, the question that arises is set the goods replaced under a guarantee as those goods are again freed from cost. But, normally the vendor is charged the warranty cost at the time of delivery, that's hidden within the very last rate of the product.

GST on Allocation of Common Expenses:

Intra-employer transactions are proposed to be taxed below GST. Any secondment of personnel, sharing of not unusual costs among related organizations would be taxed. Though the receiving entity would be entitled to avail credit of tax charged through the providing enterprise, this will result in the requirement of extra running capital for all such agencies.

Image Source gstindia

Branch Office (“BO”) and Head Office (“HO”) Transactions:

BO and HO are separate folks for the functions of GST levy. It turns into vital to decide the region of delivering of the transaction so as to decide GST implications. Should the area of delivering be in India, then as in step with Section 10 of the Integrated Goods and Service Tax (“IGST”), the transaction shall be subject to IGST beneath reverse price.

GST will be applicable wherein remote places BO is supplying to Indian HO, Indian BO offering to Indian HO and vice versa.

GST on Advance Payment:

From some bizarre provision below the GST Act, GST on strengthening payment is one. In the prevailing situation except for carrier tax, the no different law calls for to pay tax on advances. Now the taxpayer will pay GST on the advancement of products and services in GST. After giving a boost to the supplier the client will now not get the credit of GST. Whenever the dealer materials goods or services and offers the tax invoice to the receiver then best the customer will get the credit of GST. If the fees can’t be ascertained at the time of taking improve, then GST could be charged @ 18%. The money can be blocked for at some stage in this time until the delivery is finished. Similarly, the supplier will charge GST on the remaining quantity through deducting the improvement from the full amount. Every small or huge commercial enterprise will pay attention towards accounting and have to be compliant with the law. Accounting software program’s need to be upgraded to price tax primarily based on receipt invoice.

Image Source gstreadyindia

While GST is yet to come back into effect, it's going to evolve post implementation. Further, though clarity on diverse essential troubles affecting the enterprise is nevertheless unanswered, the advantage to the economy can't, in reality, be undermined.

For any Query or wants similar information, please in touch

offerings@rbassociates.Net

Edited By articlesworldbank.com

Read more

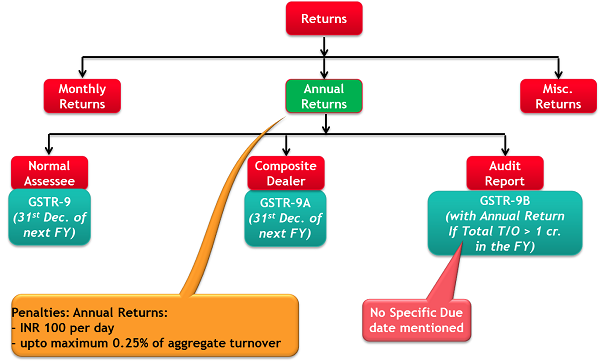

Step by step guide explaining the system of filling and submitting Form GSTR-3B.

Step by step guide explaining the system of filling and submitting Form GSTR-3B.

GST Return Filing: How To Fill GSTR-3B, Submit Form In 10 Steps

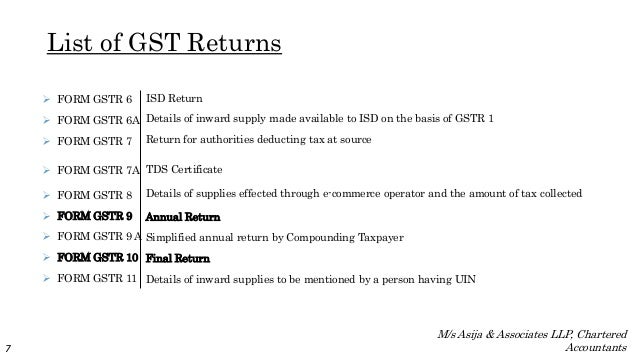

The GST Network or GSTN has come out with a step by the aid of-step guide explaining the system concerning filling and submitting Form GSTR-3B.

Image Source TaxGuru

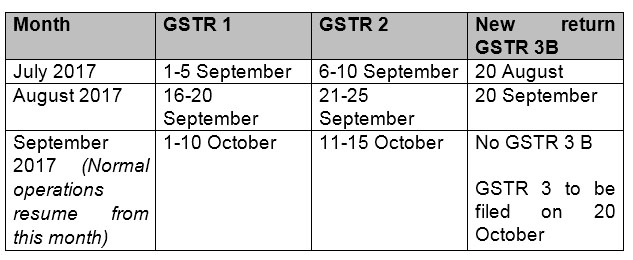

The government has extended the ultimate date for businesses to report their first returns under GST or Goods and Services Tax the use of Form GSTR-3B. The earlier deadline of August 20, for the filing of returns in opposition to July 2017, has now been extended with the aid of five days, the finance ministry said an ultimate week. Now, groups have until August 25, 2017, to submit a summary of self-assessed tax liabilities using Form GSTR-3B. The GST Network or GSTN has come out with a step-by means of-step manual explaining the technique of filling and submitting Form GSTR-3B. As per dates notified through the government, info regarding outward elements for the month of July 2017 will be filed in Form GSTR-1 among September 1 and September 5. However, within the meantime duration, businesses have to document Form GSTR-3B.

Image Source ExcelDataPro

The Form GSTR-3B will include consolidated information of outward materials and input tax credit (ITC).

The government additionally notified that August 25, 2017, closing date will even practice to taxpayers who do now not want to avail of transitional credit score in Form TRANS 1 this month. Those who need to fill up Form TRANS 1 this month, the last date can be August 28, 2017, as introduced earlier. While Form Trans 1 is to be utilized by manufacturers and offerings providers already registered underneath erstwhile critical laws earlier than GST, buyers not susceptible to be registered underneath those legal guidelines are required to use Form Trans 2.

Image Source Forbes India

The authorities also stressed on well-timed filing and "no longer watch for the last date. Suitable notification is being issued shortly."

GSTN (Goods and Services Tax Network), which operates the GST Common Portal - gst.Gov.In, has given the subsequent hints on how to file the GST Return-3B or GSTR-3B:

Image Source CAclubindia

1. After logging in, pick 'Return Dashboard'. After this, choose the month and monetary yr - which in this case may be July and 2017-18. Click the 'Search' button and choose GSTR-3B.

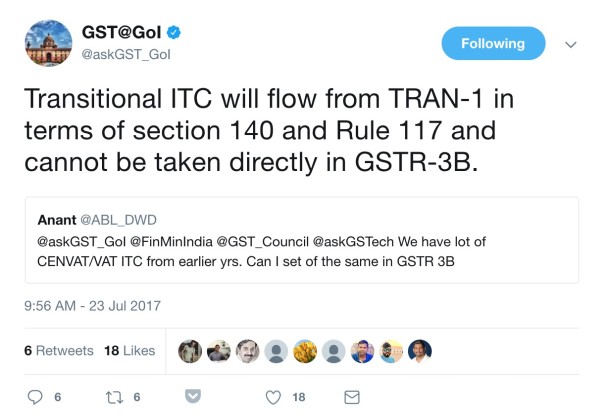

2. Declare your liabilities and ITC (enter tax credit) claims. This can be done in Section 3.1 and Section 4 and. "Transitional ITC cannot be claimed in GSTR 3B," the GST portal noted, adding: "It may be claimed only thru TRANS 1 and TRANS 2."

three. After this, the consumer is needed to go into info of interest, if payable. This can be filled in Section five.1. The past due to charge will be computed by way of the system, the GST portal introduced. Click the 'Save GSTR-3B' button.

Image Source SlideShare

Four. After saving the entered info, a button called 'Submit' may be enabled. "Please observe that after publish, no change is feasible. Hence ensure that info is crammed efficaciously before clicking on Submit button," GSTN stated at the portal.

5. After the user pushes the 'Submit GSTR-3B button', the machine will "submit (debit) the self-assessed liabilities consisting of gadget generated overdue charge in Liability Register and credit score the claimed ITC into ITC ledger".

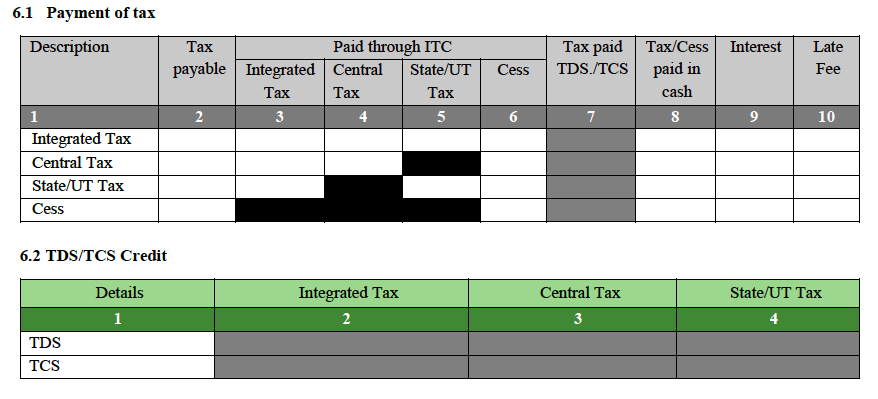

6. After this step, the Payment of Tax option (as proven in the picture) can be enabled. The consumer is required to click on on the title and claim fee info. Doing so offsets the legal responsibility.

Image Source CAclubindia

7. The person can click on at the 'Check Balance' button to view the balance to be had for credit score underneath Integrated Tax, Central Tax, State Tax and Cess.

8. At this level, the consumer is needed to fill out the segment that specifies how she or he wants to set-off the liabilities. This can be accomplished by using a mixture of cash and inputs tax credit score. Among different info, the machine checks whether or not you've got enough coins-ITC stability and whether or not all liabilities are set-off. "Part price isn't allowed in GSTR-3B," the portal added.

Image Source legal raasta

9. After this step, the user can click on on the 'Offset Liability' button to repay the liabilities.

10. A statement is to be submitted through choosing the approved signatory submitting the Form GSTR-3B. Once this is performed, click the 'File GSTR-3B' button. "A message for a hit filing will seem and Acknowledgement will get generated," the GSTN introduced in its manual.

Image Source KnowyourGST

Edited By articlesworldbank.com

Read more

What is RERA Act? Know Your Rights & Duties as Buyers.

What is RERA Act? Know Your Rights & Duties as Buyers.

RERA Act or The Real Estate (Regulation Development) Act, 2016 has come into impact from May 1, 2017, in thirteen states and union territories. With a hope to permit an obvious and green surroundings for each shopper and assets developers, the government has surpassed the RERA Act. Through this act, the government aspires to sell duty, efficiency, transparency within the device and facilitate a regulated real property region.

We will cover the RERA Act in details as a series of articles overlaying diverse components of this act.

Image Source business world

RERA Act Definition:

The Real Estate (Regulation And Development) Act is an Act to establish the Real Estate Regulatory Authority for regulation and promotion of the real estate sector and to make certain sale of plot, condo or constructing, as the case can be, or sale of actual estate project, in an green and transparent manner and to guard the interest of clients inside the actual estate zone and to establish an adjudicating mechanism for quick dispute redressal and also to establish the Appellate Tribunal to hear appeals from the choices, guidelines or orders of the Real Estate Regulatory Authority and the adjudicating officer and for subjects linked therewith or incidental thereto.

The Real Estate (Regulation Development) Act has diverse essential provisions for the benefit of customers.

Image Source Housing

Rights and Duties of Allottees/ Buyers:

(1) The allottee shall be entitled to gain the information regarding sanctioned plans, format plans alongside the specifications, authorized by the in a position authority and such other data as provided in this Act or the rules and policies made thereunder or the agreement on the market signed with the promoter.

(2) The allottee shall be entitled to recognize stage-clever time schedule finishing touch of the project, including the provisions for water, sanitation, power and other services and services as agreed to among the promoter and the allotted according to with the terms and conditions of the agreement for sale.

Image Source Housing

(3) The allottee shall be entitled to claim the possession of rental, plot or building, because the case may be, and the association of allottees shall be entitled to claim the possession of the not unusual regions, as according to the statement given by the promoter.

(4) The allottee will be entitled to assert the refund of quantity paid alongside hobby at such fee as may be prescribed and repayment in the way as provided underneath this Act, from the promoter, if the promoter fails to comply or is not able to offer ownership of the condominium, plot or constructing, as the case can be, according with the phrases of agreement for sale or because of discontinuance of his commercial enterprise as a developer as a result of suspension or revocation of his registration beneath the provisions of this Act or the policies or rules made thereunder.

Image Source ET Realty

(5) The allottee will be entitled to have the necessary files and plans, such as that of not unusual areas, after handing over the physical possession of the apartment or plot or building as the case can be, by the promoter.

(6) Every allottee, who has entered into an settlement on the market to take an apartment, plot or building as the case may be, beneath section thirteen, shall be accountable to make essential bills in the manner and in the time as precise within the said agreement on the market and shall pay at the proper time and location, the share of the registration costs, municipal taxes, water and power prices, preservation prices, floor rent, and different charges, if any.

Image Source IndiaFilings

(7) The allottee will be at risk of pay hobby, at such charge as can be prescribed, for any delay in charge closer to any amount or prices to be paid below sub-phase (6).

(8) The responsibilities of the allottee below sub-segment (6) and the liability closer to hobby below sub-segment (7) can be reduced while at the same time agreed to between the promoter and such allottee.

(9) Every allottee of the rental, plot or constructing as the case can be, shall take part towards the formation of an affiliation or society or cooperative society of the allottees, or a federation of the same.

Image Source LocalAgentFinder

(10) Every allottee shall take physical possession of the condominium, plot or be constructing because the case can be, inside a period of two months of the occupancy certificates issued for the stated condo, plot or building, as the case may be.

Image Source ET Realty

(11) Every allottee shall take part in the direction of registration of the conveyance deed of the condo, plot or building, as the case can be, as supplied underneath sub-section (1) of phase 17 of this Act which states that the promoter shall execute a registered conveyance deed in favour of the allottee in conjunction with the undivided proportionate name inside the common regions to the affiliation of the allottees or the competent authority, as the case can be, and surrender the physical ownership of the plot, condo of building, because the case can be, to the allottees and the not unusual areas to the affiliation of the allottees or the ready authority, because the case may be, in a real estate undertaking, and the opposite name documents pertaining thereto inside detailed length as consistent with sanctioned plans as provided underneath the local laws.

Image Source Moneycontrol

Edited By articlesworldbank.com

Read more

The euro had less success in opposition to the U.S. Dollar, easing 0.2 percent to $1.1193.

The euro had less success in opposition to the U.S. Dollar, easing 0.2 percent to $1.1193.

Sterling Shaken through UK Election surprise, damage restrained some other place

Sydney: Sterling fell sharply on Friday as British elections seemed to leave no unmarried party with a clear claim to power, sideswiping buyers who had already weathered predominant risk activities within the United States of America and Europe.

The pound shed as tons as 3 US cents at one point in nerve-racking trade, or near 2 percentage, before steadying as the results waxed and waned.

Futures for the FTSE eased 0.3 percent, whilst yields on 10-year gilts dipped three foundation factors to 1.00 percent.

The harm changed into limited some other place, with E-mini futures for the S&P 500 flat.

Japan's Nikkei brought 0.8 percent and MSCI's broadest index of Asia-Pacific shares out of doors Japan inched up 0.3 percentage.

Image Source NDTV Profit

The rot began while an go out ballot confirmed Prime Minister Theresa may additionally be Conservative birthday party ought to fail to win a clear majority, a surprise end result that might plunge home politics into turmoil and delay Brexit talks.

Early consequences confirmed a big swing to Labour but left the outcome unsure, with the BBC forecasting the Conservatives should hold 322 seats. For the modern updates, click on.

The exit poll had predicted the ruling Conservatives would claim 314 seats in the 650-member parliament and the competition Labour birthday celebration 266, leaving no clear winner whilst markets had assumed may would without problems growth her majority.

Image Source Nasdaq

Making a bet corporations had been already taking wagers on whether or not might also lose her job.

"it is clear that the election is an embarrassment for the Tories, who blew a massive poll lead in just a few weeks," stated Sean Callow, senior foreign money analyst at Westpac.

He anticipated a hung parliament could strip the pound of all the profits made since the election became called and go away it wallowing around $1.2500.

"We might be heading for a duration of market uncertainty, in order to be compounded via the elephant inside the room this time round -- the coming near near Brexit negotiations," stated Michael decide, head of corporate dealing at dealer OFX.

"funding selections are possible to be placed on maintaining for the short to medium time period -- simply until we have clarity on who governs the UK. At that moment, this is every person’s wager."

Image Source DieselGasoil

by 0150 GMT Sterling had shed 1.2 percentage to $1.2785, having in advance carved out a -month trough of $1.2693. It turned into additionally down 1.2 percent at the euro at 87.Fifty nine pence.

The Japanese yen gave up early gains to ease to one hundred ten.22 according to the dollar. Fantastically rated sovereign bonds were in the call for with U.S. 10-12 months Treasury futures gaining 2 ticks.

The euro had less success in opposition to the U.S. Dollar, easing 0.2 percent to $1.1193.

The single foreign money had slipped overnight whilst the EU-critical bank cut forecasts for inflation and said it had now not mentioned scaling again its big bond-shopping for a marketing campaign, sending bond yields to multi-month lows.

Image Source DieselGasoil

NO SMOKING GUN

in a single day, Wall Avenue had reputedly judged the testimony of former FBI director James Comey was now not lifestyles-threatening to the management of President Donald Trump.

Comey accused Trump of firing him to attempt to undermine the investigation into possible collusion by way of his campaign team with Russia's alleged efforts to persuade the 2016 election.

"I suppose the marketplace is taking less of an alarmist evaluate of this example due to the fact there is no smoking gun right here," stated Jefferies & Co cash market economist Thomas Simons.

"So it's not especially impactful for considering... Trump's monetary schedule to go through."

The Dow rose 0.04 percentage, even as the S&P 500 won 0.03 percentage and the Nasdaq Composite 0.39 percentage.

In commodity markets, spot gold became a whisker decrease at $1,274.30 an oz.

Oil expenses remained subdued with Brent having settled at its lowest given that Nov. 29, the eve of an OPEC manufacturing reduce deal.

US crude futures edged up 2 cents to $45.66 a barrel, with Brent crude up 4 cents at $47.90.

Edited By articlesworldbank.com

Read more

Here are valuable tips to help you make a portable application for your independent company

Here are valuable tips to help you make a portable application for your independent company

Tips to Create a Mobile App for Your Business

Portable applications are presently some portion of each possible business, independent of their size and number of clients. Versatile is the least demanding technique to draw in your clients, while additionally pulling in new ones toward your business. Versatile applications offer you a solitary stage from where you can work an assortment of different procedures, for example, advancing your item; winning income by a method for in-application promoting; offering markdown and coupon codes; getting your clients to get the message out on the web et cetera. Consequently, making a portable application for your private company is certainly gainful. It is particularly the case in the event that you maintain an independent venture and might want to achieve more clients through the versatile channel.

Image Source quora

Do You Need to Develop a Mobile App for Your Business?

Here are valuable tips to help you make a portable application for your independent company:

In-House Development Team versus Outsourcing

While a few organizations like to build up their own particular in-house versatile advancement group, it might be prudent for you to outsource a group with a specific end goal to help you make your portable application. More often than not, an organization's in-house group would not be sufficiently experienced to manage all application advancement related issues. Procuring an expert, then again, would free of all worries identifying with application advancement.

Image Source ardas

Enlisting an independent portable engineer is presently very moderate and would likewise create the coveted outcomes inside a significantly shorter traverse of time. Contracting a nearby engineer would guarantee that he or she is available in all circumstances.

Contract a Professional Developer to Create Apple iPhone Apps

Try to talk about all parts of your portable application and plan out everything to the last detail before really proceeding to make your versatile application. Attempt and remove all additional or superfluous functionalities – some of them can most likely be included in future updates. Guarantee that the primary rendition of your application is perfect, uncluttered and sufficiently simple for client route.

Once the application has been made, the following stride is tested it completely for bugs and different issues. Discharge the application just on the off chance that you are totally happy with the experience yourself.

The most effective method to Choose the Right Mobile Platform for App Development

Image Source cult of mac

Portable is no longer only an extravagance, which is accessible to a restrictive class of society. It has now risen as a need for clients, designers and organizations alike. Clients who once perused Websites now do as such, on their cell phones. Everything, including installment, has now turned out to be versatile.

Subsequently, it would be attractive for you to move with the changing circumstances and adjust to the most recent versatile innovations. It is not any sufficiently more to just get somebody make an application for your business – you likewise require an IT group which is "portable educated" and can deal with post versatile application improvement viewpoints, for example, building up a powerful portable methodology, advancing the application et cetera.

Versatile Advertising: Tips to Select the Right Mobile Ad Network

Image Source hongkiat

Today, every last organization needs to make a sufficiently capable versatile nearness. In the event that you are not prepared to build up a versatile application for your business yet, you ought to think about the following best thing – that of making a portable Website to exhibit your items and administrations. This Website ought to in a perfect world be good to view on various diverse cell phones.

Your in-house group would no doubt be sufficiently equipped to deal with the formation of a versatile adaptation of your Website. Arrange out the functionalities you need to incorporate into your portable Website and examine angles identifying with representation and UI alongside your visual originators and lead engineers. When you have the whole arrangement set up, you could likewise simply ahead and outsource a designer or group of engineers to make a portable application for you. This would likewise work out simpler and substantially more cost-effective for you.

Step by step instructions to Develop a Cost-Effective Mobile Platform

Image Source sap

In Conclusion

You should do a touch of research with a specific end goal to enlist the privilege application designer or group. You could ask your business contacts or visit gatherings on the web and post your inquiry. When you pick an engineer, take after the previously mentioned ventures to guarantee that your application advancement process is smooth and inconvenience free.

Edited By articlesworldbank.com

The most effective method to get your obligation under control

The most effective method to get your obligation under control

Obligation really makes you wiped out. Here's the reason — and how to pay off the cash you owe to appreciate life once more.

Obligation can actually make you wiped out.

You definitely realize that obligation is awful for your funds. Be that as it may, what you may not understand is that it can influence your wellbeing too — particularly on the off chance that you fall behind on your installments.

Upwards of 80% of Americans are in some sort of obligation, as indicated by a 2015 Pew Charitable Trusts report. While contract obligation is most normal, Visa obligation, auto advances and school obligation are burdening us too.

What's the greater part of this obligation doing to our wellbeing? No good thing. Obligation can affect both your physical and mental state. Here's the manner by which obligation can influence you, and a few tips for handling your obligation issue to ensure your wellbeing.

With obligation loads nearing 2008 record levels, Americans are progressively spending more than they can bear. That can be unpleasant. 72% of Americans said they felt worried in regards to cash, as per a 2014 "Worry in America" overview by the American Psychological Association, with 22% detailing "outrageous" worry over their funds.

Budgetary anxiety triggers a battle or-flight reaction and surges the body with stress hormones, bringing about everything from heart beating to expanded sweating, Harvard Health Publications reports. While that might be helpful on the off chance that you are attempting to fight off a tiger, the production expresses that "after some time, rehashed initiation of the anxiety reaction incurs significant damage on the body."

That can prompt tension or wretchedness. "Experimental reviews have found that money related strains, for example, individual obligation and home dispossessions are solid indicators of discouragement, general mental misery, mental clutters and self-destructive ideation," as per a recent report in Social Science and Medicine.

Obligation can make you physically sick

Obligation doesn't simply affect psychological wellness. It can effectsly affect your physical wellbeing. "Stretch, particularly money related or different anxiety that goes on for quite a long time, weeks, months or even years, can affect your resistant framework and make you surrender to ailments faster," US News and World Report notes.

A current working paper distributed by the Federal Reserve Bank of Atlanta even proposes obligation is connected to higher death rates. Ending up plainly truly reprobate on only one record created a 5% expansion in mortality hazard in the three months after the wrongdoing, in spite of the fact that dangers in the long run come back to typical. Then again, a 100 point FICO rating increment brought about a 4.38% decrease in mortality hazard.

"People with better credit or littler measures of reprobate obligation had a lower likelihood of death at any given point in time than those with more awful individual accounts," as per Pinnacle's write about the review.

Obligation stress is not kidding

The most effective method to get your obligation under control

In the first place things first: If you're concerned you wouldn't have the capacity to pay the bills, investigate choices to abstain from falling behind. Check whether you're qualified for understudy credit suspension or self control or investigate a reimbursement arrange with littler installments in light of you salary. Simply conversing with your loan specialist could help, as they may give you to arrange an installment a chance to arrange.

You may likewise have the capacity to combine your Visa obligation by exchanging the adjust on a high-intrigue charge cards to ones with a 0% rate. Simply recollect that the 0% rate won't keep going forever: You regularly have in the vicinity of 12 and year and a half to pay it off before you need to begin paying interest once more.

In case you're not behind on installments but rather still have a ton of obligation, work on an arrangement to pay off what you owe at the earliest opportunity. On the off chance that you have a rainy day account, it may be insightful to put a few (yet unquestionably not all) of it toward your most astounding interest obligation.

In the event that you'll require a while to pay off what yo owe, making a spending will give you a superior thought of the amount you can reasonably stand to pay every month. At that point consider a couple reimbursement techniques like the obligation snowball or obligation torrential slide to quicken your installments.

On the off chance that that is insufficient, you might need to consider way of life changes like getting a flat mate, finding a side hustle or — if all else fails — moving in with mother and father so you can commit a greater amount of your cash to reimbursing what you owe.

Edited By articlesworldbank.com

Read more

Is Chip Your Future work ID a microchip embed in your body?

Is your future work ID a microchip embed in your body? These specialists have made the jump.

It's just human, also disappointing, to overlook passwords or lose your telephone, keys or work ID. Be that as it may, is implantable chip innovation the answer for make life more helpful — and would you permit your boss to embed a modest chip into your body to change you into a cyborg of sorts?

That is a question being effectively investigated at a Swedish organization, Epicenter, where specialists are as of now giving their manager a chance to embed a little microchip — the extent of a grain of rice — in their grasp. The chip permits workers to open entryways, utilize innovation easily and even buy sustenance without fumbling for key cards, charge cards, telephones or passwords. Specialists are notwithstanding facilitating insert gatherings for their recently chipped partners.

Of the organization's 2,000 workers, 150 have experienced the method, which includes syringes that infuse a chip into the hand alongside the thumb. "Individuals ask me, 'Are you chipped?' And I say, 'Yes, why not,'" Fredric Kaijser, 47, boss experience officer at Epicenter, told AP.

The microchips work by utilizing close field correspondence, likewise found in tap-and-go innovation like Apple Pay, with information that is lucid by means of electromagnetic waves.

While Epicenter representatives say they appreciate the comfort of being chipped, specialists caution that such innovation has encourage achieving suggestions than just having the capacity to arrange a smoothie with a hand wave: in principle, at any rate, AP reports, bosses or programmers later on could track wellbeing information, precisely to what extent representatives work and even how frequently they utilize the lavatory.

Could comfort meddle with security?

Implantable chip innovation has been accessible to pet proprietors for quite a long time. Furthermore, no less than one European tech official has tried different things with NFC chip implantation in his grasp — to help speed through plane loading up. Be that as it may, the size of the Epicenter activity takes the tech to another place.

"The information that you could get from a chip that is implanted in your body is a considerable measure not the same as the information that you can get from a cell phone," Ben Libberton, a microbiologist at Stockholm's Karolinska Institute, told AP.

That is on account of a chip in your body is significantly more private, posturing potential security dangers on the off chance that you don't need anybody to think about your wellbeing or whereabouts, he said.

For sure, in their book The Dynamic Human, writers Maciej Henneberg and Dr Aurthur Saniotis contend that what's to come is arriving rapidly, in a manner of speaking, and people are ending up plainly progressively reliant on gadgets. They refer to the expanded coordination of human tissue with innovation like computerized inserts interfacing brains to PCs, nanotechnology and medicinal prosthetics. That is one reason future laws should adjust to help ensure individuals in the period of cyborgs, as a 2014 a Brookings Institute paper contends.

Meanwhile, you'll need to choose for yourself how agreeable you are with turning into a cyborg. On the off chance that you can't beat them, would it be advisable for you to go along with them?

Edited By articlesworldbank.com

Read more

Take some precautions before if you submitting your 2016 returns first time.

Take some precautions before if you submitting your 2016 returns first time.

There are some advice for doing your expenses like a manager from the get-go.On the off chance that you approach your folks for help with expenses each year, you're not really alone: At minimum 33% of millennials swing to Mom and Dad come charge time, as indicated by a current study by TaxAct. Be that as it may, while getting counsel isn't a terrible thought — at any rate, you have to know whether despite everything they plan to claim you as a ward.

Doing your charges interestingly may appear to be overwhelming, yet it's really the most straightforward when you're youthful, in light of the fact that you are more averse to be hitched, have children, claim a home or have whatever other conditions apply to you that make documenting more convoluted.

There are some advice for doing your expenses like a manager from the get-go.

Begin by social event reports, including your W-2(s) and any 1099 structures for money from independent work, banks or speculation accounts. On the off chance that you moved out of your folks' home in the previous year, inquire as to whether they have them. Additionally check on the web, the same number of budgetary organizations post the reports you require ideal for you.

Bosses are required by law to give your W-2 by January 31. On the off chance that you haven't gotten a W-2 from any organization you worked for, get in touch with them. On the off chance that you can't contact them, contact the IRS, which can help you discover a workaround.

You'll need to claim a few reasonings to recover the most cash from Uncle Sam. Charge programming will walk you through any advantages you might be qualified for, yet some basic ones incorporate altruistic commitments, understudy credit intrigue and your 401(k) or IRA commitments. Ensure you have records for all findings, regardless of the possibility that it is only a bank or financial record.

2. Not certain what printed material you require? Request counsel.

Mother and Dad might be your first stop for counsel. Your folks or a trusted guide can let you know whether you have all your printed material in line and what documentation you require, Glenn Brown, an assessment expert at the Tax Institute at H&R Block, said in a telephone meet.In spite of the fact that it might be clear to you before you ask, you may discover you are missing key snippets of data, just by conversing with somebody who has done this multiple occassions previously.

One apparatus your folks didn't have when they were your age is access to online assets. Supportive articles and free guidance are all over the place. On the off chance that you need face to face help, scan "with the expectation of complimentary duty counsel" in your general vicinity for various stroll in assessment focuses.

When in doubt, connect with the IRS. Simply recall that the nearer it is to duty day, the more you'll need to hold up to address a genuine individual.

3. Take care of business and begin rounding out those tax documents

Alright, so you're prepared to begin. In any case, hold up. Which tax document would it be advisable for you to utilize? The regular first time filer is sheltered with the 1040EZ shape. "First-time impose filers ordinarily don't have many expense issues so the 1040EZ is a straightforward procedure, and regularly economical for your profits," Brown said.

In any case, here's a mystery: You don't have to know which frame you are recording out when you begin doing your expenses online in light of the fact that duty programming consequently picks the correct ones in view of the data you give. Cool, huh?

Begin by making sense of on the off chance that you can petition for nothing. IRS Free File gives free online duty programming to the individuals who make $64,000 or less, and TurboTax, Credit Karma, TaxAct and H&R Block all have free arrangements for individuals with basic government forms and insignificant findings. In the event that you can't locate a free program you like, consider moving up to a paid variant, which generally accompanies more help as live talk or telephone support, and more direction as you fill in your data.

A paid duty preparer ought to be your final resort, as they will probably cost a few times the cost of online programming. On the off chance that you do go this course, check whether Mom and Dad's bookkeeper may offer you a reprieve on the cost. Additionally consider inquiring as to whether they have an IRS-endorsed charge preparer they like.

4. Bear in mind to spare a duplicate of your arrival

Mother and Dad most likely have duplicates of your old government forms, however now that you're doing this all alone, you have to begin documenting these yourself. The IRS prescribes keeping at any rate the previous three years of assessment form data.

Sparing a duplicate of your arrival will make it simpler to round out your structures one year from now (since assessment programming quite often gets some information about past returns) and revise your arrival after you document on the off chance that you've committed an error. Past returns likewise prove to be useful for checking your wage when leasing a loft, purchasing a home or applying for a credit.

While keeping a printed version is dependably a smart thought, you can likewise download an electronic duplicate. A few projects, for example, TurboTax and TaxAct, will even store your past returns for you.

5. Also, now for the fun part — following your discount!

Discounts normally take 21 days or less to arrive, however the hold up can be agonizing. In the event that you get fidgety, there are two approaches to track your discount: through the IRS' Where's My Refund website or through your online expense arrangement programming.

Edited By articlesworldbank.com

Read more

All limitations on money withdrawal from financial balances expelled from today

All limitations on money withdrawal from financial balances expelled from today

Limitations put on money withdrawals from financial balances after Center's demonetisation drive on November 8, 2016, was totally evacuated today.

The limitations put on money withdrawals from financial balances after Center's demonetisation drive on November 8, 2016, was totally evacuated today.

The Reserve Bank of India had declared a month ago that all tops on money withdrawals would end on March 13.

The points of confinement were forced after Prime Minister Narendra Modi declared the choice to scrap 86 for every penny of aggregate money in Rs 500 and Rs 1000 notes, around Rs 15.44 lakh crore, on November 8, making colossal money smash the nation over.

The cutoff points were progressively facilitated to Rs. 50,000 every week on February 20.

"Powerful March 13, 2017, there will be no restrictions on money withdrawals from Savings Bank accounts," the RBI had said in a notice on February 8.

The RBI had effectively expelled limitations on money withdrawals from Current records on January 31, 2017.

The national bank is yet to give the last figure on the amount of the demonetised cash has been saved in banks after demonetization was declared.

A month ago, the peak bank said it was yet to gather every one of the information.

It said that every one of the focuses of the RBI is yet to send the information on old notes and NABARD has additionally not given the information on stores in agreeable banks. The information on notes available for use in Bhutan and Nepal is additionally not been gathered, the RBI said.

Alongside every one of this information and stores made by NRIs after December 30, 2016, the due date will it have the capacity to tell how much old notes are back in banks, the RBI said.

Edited By articlesworldbank.com

Read more

Reconsider penalty for not keeping minimum balance: Govt to SBI

Reconsider penalty for not keeping minimum balance: Govt to SBI

The government these days asked SBI to rethink its call to levy penalty on non-maintenance of minimum balance, that the bank plans to hike manifold from Gregorian calendar month one impacting over thirty one large integer savings checking account holders.

State Bank of Republic of India, consistent with a supply, has additionally been asked to rethink charges it proposes to levy on money transactions and ATM withdrawals over fixed limits.

The country's largest investor has declared imposing penalty starting from Rs 20-100 on non-maintenance of Minimum Average Balance (MAB) in savings bank accounts from Gregorian calendar month one.

The penalty is as high as Rs five hundred just in case of current accounts.

The penalty for breach of MAB is being reintroduced once a spot of 5 years.

The bank has additionally augmented the minimum balance demand by over and over, that is as high as Rs five thousand for account maintained with branches in six metro"s.

SBI has additionally obligatory restrictions on withdrawals of money from its branches yet as ATMs. These can attract charges once bound fixed limits.

"Government has asked SBI to rethink it's call to impose a penalty on non- maintenance of minimum balance in accounts from Gregorian calendar month one forwards," the supply same.

The government has additionally urged SBI and alternative lenders, together with personal sector banks to "reconsider the fees on money transactions and ATM withdrawals on top of a precise limit".

Some personal banks, like HDFC Bank, ICICI Bank and Axis Bank, have started charging a minimum quantity of Rs a hundred and fifty per dealing for money deposits and withdrawals on the far side four free transactions in a very month.

Edited By articlesworldbank.com

Read more

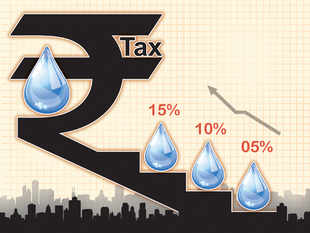

mistakes to keep away from even as doing tax making plans in 2017

Mistakes to keep away from even as doing tax making plans in 2017

one of the most important funding mistakes we make in the course of pressing times is to invest simply to avail the tax deductions. Do not consequently make any funding just for the tax deduction.

Tax planning isn't approximately saving taxes however it's miles an vital a part of universal monetary planning and have to preferably be deliberate for the duration of the year.

however regrettably, we all don't forget it one time activity which we adopt generally inside the last three months of the economic yr with out giving lots thought on how it's far going to effect our average price range.

" one of the biggest funding mistakes we make at some stage in urgent times is to invest simply to avail the tax deductions. Do not consequently make any investment just for the tax deduction. sensible investments will make certain that the investments made are relevant to your wishes," says Anil Rego, CEO and Founder, proper Horizons.

There are only 3 months left for doing tax-saving investments for the year 2015/sixteen. maximum of you will have acquired emails out of your human aid department to publish tax proofs. So, if you have no longer carried out your tax saving investments for the yr yet, try no longer to commit the following errors in haste.

1) making an investment too much into fixed profits: investing in debt units is important because it presents stability in your portfolio. however having too much of debt including public provident fund, personnel provident fund, fixed deposits and so on won't be properly for the overall go back of your portfolio. So, preserve the debt-fairness ratio balanced. if your portfolio is already debt heavy, it would be wiser to invest in equity units. parent out the ideal debt-fairness ratio to your portfolio and pick out the instrument as a result.

2) no longer searching past section 80C: maximum of you recognize that you could claim a deduction of as much as Rs 1.five lakh beneath segment 80C however you can additionally claim tax deduction against the top rate paid for your health insurance. So, if you assume your medical health insurance cowl isn't always sufficient, you can think of growing it. further, if you are involved in philanthropic sports, you could also declare deduction in opposition to donations to political events and for clinical research, rural improvement and authorities remedy works are also deductible. So, try to recognise greater about the deductions you may claim. look past phase 80C.

three) investing in lumpsum in equities: a number of the buyers do spend money on equity connected saving schemes presented by way of mutual finances which qualify for tax deduction beneath phase 80C. however the mistake they do is they invest in lumpsum, which makes them extra liable to the hazard of losing money as by making an investment in lumpsum, they're definitely timing the marketplace. consequently, it's miles usually really helpful to unfold the investments for the duration of the year.

4) making an investment in endowments insurance plans: in case you walk to a financial institution for the duration of tax saving season, the consultant is probable to push various products in an effort to be earning high fee for the financial institution but won't be the right product for you. Endowment plans are one in all them.

the majority do now not realize that an endowment plan is a long-time period product with a adulthood period of 10-two decades. in case you pay top class for handiest five years and then redeem the investment, it is probable that you'll get much less than even your main. in addition they do not recognize that a part of the endowment plan top rate goes in the direction of mortality fees and distributor fee.

Edited By articlesworldbank

Read more

A way to calculate the EMI on your loan

A way to calculate the EMI on your loan

New Delhi-based keep supervisor, bought a automobile in 2015 really worth Rs 5.95 lakh. He made a down charge of Rs 1.5 lakh and took an vehicle mortgage for the relaxation of the quantity at 12% interest in line with annum for four years. At present, he's paying an equated monthly instalment, or EMI, of Rs 11,700 in line with month. but, he has no manner of knowing if the quantity is correct or no longer.

Like Suraj, there are many people who are confused if their lender is charging them a fair quantity as EMI. So, we determined to tell you how to calculate EMI so that you can move-take a look at that with what you've got been paying in line with month. you may calculate your EMI via the use of a bit of software program referred to as Microsoft Excel or a mathematical formula.

the usage of EXCEL

one of the easiest ways of calculating the EMI is with the aid of using the Excel spreadsheet. In Excel, the function for calculating the EMI is PMT and now not EMI. You need three variables. those are rate of hobby (price), variety of durations (nper) and, ultimately, the cost of the mortgage or gift price (pv).

The system which you can use in excel is:

=PMT(price,nper,pv).

allow us to check the EMI of Suraj by using the above system.

It ought to be mentioned that the rate used in the system need to be the monthly rate, that is, 12%/12=1% or 0.01.

The wide variety of periods represents the quantity of EMIs.

=PMT(zero.12/12, four*12, 445,000)= eleven,718

The result will are available in poor or purple, which shows the cash outflow of the borrower.

permit's take another example. suppose you are paying a quarterly instalment on a mortgage of Rs 10 lakh at 10% hobby in line with annum for 20 years. In the sort of case, in preference to 12, you must divide the rate by means of four and multiply the number of years with the aid of 4. The equated quarterly instalment for the given figures could be =PMT(10%/4, 20*four, 10,00,000).

the usage of MATHEMATICAL formula

sadly, you can't get entry to the Excel spreadsheet anywhere. In any such case, you may use your mathematical thoughts or an electronic calculator to know how much the EMI involves. The mathematical system for calculating EMIs is:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1], in which P stands for the mortgage amount or main, R is the hobby rate in step with month [if the interest rate per annum is 11%, then the rate of interest will be 11/(12 x 100)], and N is the range of monthly instalments. while you use the above method, you'll get the same end result that you will get inside the Excel spreadsheet.

Edited By articlesworldbank.com

Read more

PF (Provident Fund) money Withdrawal: right here Are five matters To know

PF (Provident Fund) money Withdrawal: right here Are five matters To know

As in step with PF regulations, 12% of an worker's salary is going into the fund in conjunction with an identical contribution from the employer

PF money can be withdrawn after months from the cessation of employment.

Provident fund (PF) is meant for saving closer to retirement years. monetary planners don't suggest withdrawal from the corpus earlier than retirement. consistent with provident fund norms, 12 according to cent of an worker's earnings goes into the fund together with a matching contribution from the agency. The EPFO (employees' Provident Fund enterprise) every yr pronounces hobby price to be paid at the amassed provident fund corpus. The PF money may be withdrawn after two months from the cessation of employment. The utility shape in this regard may be filed with PF government, or thru the organisation.

right here are 5 matters to recognise:

1) To inspire long-term financial savings, the government has formulated tax legal guidelines therefore. If the withdrawal from a acknowledged PF occurs after five years of non-stop employment, it attracts no tax liability. In case of employment with unique employers, if the PF balance maintained with the vintage employer is transferred to the PF account of the new business enterprise, it's far considered a continuous employment. (also read: I need To keep sufficient money For Retirement. Is PF Contribution enough?)

If an employee has been terminated due to sure reasons beyond his or her manipulate (together with sick health and discontinuation of enterprise of company), a withdrawal does not attract any tax, irrespective of the wide variety of years of employment.

2) In case of a withdrawal before 5 years, the quantity turns into taxable inside the same economic yr. consequently, the quantity must be shown in your tax go back for the next evaluation yr.

3) The company's contribution to PF and interest earned on it is brought to one's income and taxed as a consequence.

four) further, if you have claimed blessings beneath segment 80C in your own PF contribution, it will be taxed as revenue. The interest earned on your personal contribution might be taxed as 'income from different resources' and taxed in step with the respective tax slabs.

five) TDS (tax deducted at supply) - If the withdrawal is after a period of five years of continuous employment, it attracts no TDS or any tax. What occurs if the length of carrier is less than 5 years? If PAN has not been submitted to the EPFO government, TDS is deducted at 30 according to cent. If PAN has been submitted in conjunction with form 15G/15H, no TDS is deducted. If form 15G/15H isn't submitted and PAN is submitted, TDS @ 10% is deducted. form 15H or 15G is meant to prevent TDS for those whose profits falls underneath the taxable limit.

Edited By articlesworldbank.com

Read more

Modifying your Income Tax returns post demonetisation may arrive you in prison

Modifying your Income Tax returns post demonetisation may arrive you in prison

In a stern cautioning to assessees attempting to abuse the arrangement of updating I-T returns, CBDT today said those "definitely" changing the structures to overhaul wage will confront examination and corrective activity.

The Central Board of Direct Taxes (CBDT), the approach making body of the wage assess office, additionally said if the division sees any control in salary in earlier year's ITR (pay expense form), it will lead investigation.

In a stern cautioning to assessees attempting to abuse the arrangement of modifying I-T returns, CBDT today said those "definitely" adjusting the structures to update salary will confront examination and corrective activity.

It said that post demonetisation reported on November 8, a few citizens may abuse this arrangement to update the arrival documented by them for the prior appraisal year for controlling pay with an expectation to demonstrate the present year's undisclosed profit in the prior recording.

"The arrangement to document an amended return… has been stipulated for reexamining any oversight or wrong articulation made in the first return of wage and not for falling back on roll out improvements in the salary at first announced in order to definitely change the frame, substance and quantum of the prior revealed wage," CBDT said in an announcement.

The Central Board of Direct Taxes (CBDT), the arrangement making body of the pay impose division, additionally said if the office sees any control in wage in earlier year's ITR (wage assessment form), it will lead investigation.

"Any example going to the notice of the I-T division which reflects control in the measure of pay, trade out hand, benefits and so forth and fudging of records may require investigation of such cases in order to discover the right pay of the year and may likewise pull in punishment and indictment in suitable cases according to arrangement of law," it said.

Under the Section 139(5) of the I-T Act, an amended ITR must be documented if any individual who has recorded an arrival finds any oversight or any wrong explanation in that.

Edited By articlesworldbank.com

Read more

The USPS has recognised Mahindra's engineering notion and decided on us for car development and prototype shipping.

US Postal provider shortlists Mahindra and Mahindra subsequent technology shipping vehicle

Mahindra & Mahindra today stated it is among six manufacturers shortlisted by way of the us Postal service (USPS) for next generation delivery automobile (NGDV) prototype.

Mahindra and Mahindra q1 internet income The employer has been decided on by using the USPS for NGDV prototype for testing because of a competitive Request for thought (RFP) issued in October ultimate 12 months, Mahindra and Mahindra said in a assertion. (Reuters)

Mahindra & Mahindra today said it is among six manufacturers shortlisted through the usa Postal carrier (USPS) for subsequent technology shipping car (NGDV) prototype.

The employer has been selected through the USPS for NGDV prototype for testing due to a competitive Request for concept (RFP) issued in October remaining yr, M&M said in a assertion.

The awardees will have around twelve months from settlement award to design and supply their prototypes. manufacturing necessities and destiny vehicle alternative awards might be determined by using USPS after NGDV Prototype testing.

The USPS has recognised Mahindra's engineering notion and decided on us for car development and prototype shipping. that is a strategic development in Mahindra's ambition to end up a international mobility participant, Mahindra group Chairman Anand Mahindra stated in a statement.

Mahindra's engineering and layout notion turned into led with the aid of its Southeast Michigan-based Mahindra North American Technical center (MNATC).

founded in Troy, Michigan, MNATC has leveraged the good sized pool of car engineering skills that prospers within the Detroit place to create revolutionary automobile designs for the us market.

https://twitter.com/Cleo_FrankJR/status/785486447197429760?ref_src=twsrc%5Etfw

Our group has good sized global enjoy engineering a number of the excellent vans ever produced. We've spent heaps of hours making sure this concept will optimise motive force and pedestrian safety and offer the USPS with a cutting-edge and dependable car structure that can without problems adapt to a extensive sort of destiny situations, he introduced.

Edited By articlesworldbank.com

Read more

Within the first 8 hours of the sale, almost one lakh cell telephones had been sold at Snapdeal.

Within the first 8 hours of the sale, almost one lakh cell telephones had been sold at Snapdeal.

Snapdeal's Unbox Diwali sale starts with more than 180 orders per Second

extra than million users logged into Snapdeal throughout the primary hour of sale to quick lock into the plethora of remarkable deals on provide.

The pinnacle selling mobile telephones inside the first 8 hours of the sale had been the Samsung J2 pro and the LeEco Le Max2, which flew off the shelf with big reductions padded through extra immediate bargain on Citibank cards. (Reuters) The top promoting cellular phones inside the first eight hours of the sale were the Samsung J2 pro and the LeEco Le Max2, which flew off the shelf with massive discounts padded by means of additional instantaneous cut price on Citibank cards. (Reuters)

extra than two million customers logged into Snapdeal throughout the primary hour of sale to quick lock into the plethora of tremendous deals on provide. Early developments showed a massive leap in mobiles, appliances, non-public electronics and fixtures gadgets.

The sale had a cause-satisfied begin with almost seven-hundred,thousand concurrent users flocking to the web site within the first 5 minutes. buyers who had made up their minds had already stocked millions of merchandise of their carts and wish lists before the sale began to keep away from lacking out on their chosen merchandise.

Image Source couponraja

The pinnacle selling mobile phones inside the first eight hours of the sale have been the Samsung J2 seasoned and the LeEco Le Max2, which flew off the shelf with huge discounts padded through extra immediate bargain on Citibank playing cards. within the first 8 hours of the sale, almost one lakh cell telephones had been sold at Snapdeal, translating to almost 200 telephones bought according to minute.

Voltas 5 superstar break up 1.2 T ACs at almost Rs. 20,000 turned into also a hot selling item. Lakme (Flat 30 percent) and Maybelline (Flat 20 percentage) noticed brisk income as shoppers sold their preferred cosmetics. App evaluation indicates users lingering over guys's and women shoes, which had been to be had at a nearly 50 percentage cut price.

Sony pen drives additionally appeared to have stuck the customers myth with 16GB pen drives promoting at Rs. 199. nearly 24,000 pen drives with a collective capacity of nearly 400 TB have been snapped up in the first 8 hours of sale.

Responding to the early developments, Saurabh Bansal, vp, categories at Snapdeal said. we are very excited to peer the top notch reaction within the preliminary hours of the Diwali Unbox Sale. users have loved the extra, instant discount on Citibank cards. Many more thrilling offers are lined up over the following days of the sale.

Edited By articlesworldbank.com

Read more

How you insure your gold articles against diverse risks?

How you insure your gold articles against diverse risks?

insurance for your gold keeping: how it protects the precious asset

security of valuable assets is a mission for every traders and consumers. whether it's far home, car, or difficult coins, there's constantly a chance of loss because of robbery, housebreaking, fireplace, earthquake, flood, and so on. happily, we can use specialized insurance covers to shield every object from most such dangers. in case you were to go through a loss, coverage might cover it.

insurance for automobiles, fitness, lifestyles and domestic are very well understand. however did you could also insure your gold articles insured against diverse risks? (Reuters)

coverage for automobiles, health, life and home are very well recognize. but did you understand you could also insure your gold articles insured against diverse dangers? (Reuters)

safety of valuable belongings is a mission for every investors and shoppers. whether it is domestic, automobile, or difficult cash, there may be constantly a threat of loss due to robbery, housebreaking, fireplace, earthquake, flood, and so forth. fortuitously, we will use specialized insurance covers to defend each item from most such dangers. if you were to go through a loss, insurance might cowl it.

insurance for cars, health, life and domestic are very well know. but did you may also insure your gold articles insured towards numerous dangers? There are some gold-particular standalone insurance products well as one of a kind jewellery covers beneath complete coverage merchandise. those cover gold belongings from various kinds of dangers.

you have got the choice to get your jewelry included beneath standalone jewellery coverage coverage, art and valuables insurance, or below a home coverage while getting cover for your property’s contents. Standalone gold jewelry coverage covers losses incurred in a much wider variety of incidents as compared to other insurance regulations.

protection and cowl scope

The standalone gold insurance covers your jewelry risks to the quantity for which the insurance has been taken. in case your gold and jewellery chance has been covered beneath a domestic content coverage, there may be a sub-limit for such risks in the overall hazard cover for all your own home contents. for example, your total home content material danger is blanketed as much as Rs. 10 lakh and the ceiling for jewellery hazard cover is 25%, wherein case your chance coverage is worth Rs. 2.five lakh.

below content cowl, the jewelry is included from dangers which include injuries, robbery, fire, harm, and so on. even as worn or kept specially lockers or in recommended safe custody. whilst shifting the insured article, it is blanketed for losses best if the insured takes necessary care as per the stairs prescribed via the insurer below extraordinary situations.

similar to maximum fashionable coverage merchandise, jewelry insurance has a list of exclusions. The coverage company will now not cover losses incurred because of warfare, crook acts, wilful acts, riots, and so on. It also does no longer cover losses due to depreciation, or thefts from unattended vehicle. Any loss because of repair or restoration is also not covered in most cases.

situations of the coverage

coverage agencies require a valuation certificates for insuring jewelleries above a specific fee. The ceiling amount of valuation varies from one insurer to any other. The valuation certificate may be issued via an accredited jeweller or evaluator. The insurance covers the loss to the volume of the object’s valuation at the insurance date. If the charge of jewellery rises as per market fee, the insurer isn't at risk of pay an quantity higher than the only referred to at the valuation certificates.

The insurer also calls for the insured to take proper steps to take care of and cozy his valuable articles. once an insurer makes full charge for the insured item, it gets the possession over it.

matters to preserve in mind

if you are looking to genuinely cover your valuables like jewelry or gold, you need to examine the blessings between standalone and content material coverage. Standalone coverage may want to come up with a better chance cover and it is usually wider type of dangers in assessment to the content material coverage which comes beneath domestic insurance.

in case you are looking for content material insurance you then should evaluate the sub-restrict for jewellery and valuable items based to your total cover, and take the insurance for the right amount. it's miles usually higher to opt for coverage that gives all-dangers cowl for precious objects.

if you are looking for coverage for a selected length of, say, 3 to 6 months, you ought to also check the go out clause of your coverage if it lets in you a refund in case of an intermediate give up.

Do test the valuation norms and payment phrases of the insurance corporation. if you are seeking to get jewelry insurance for the long time, i.e. more than one 12 months, it is higher to get valuations achieved each year or periodically to maintain the price updated as according to market fees, in particular if there may be an growth in the charge of objects product of gold and silver.

To report a declare after suffering a loss, you may talk with the coverage employer on the provided phone wide variety or through different eligible media. If an FIR has been lodged, post its reproduction together with the claims shape and a replica of the coverage coverage. The insurance organization will initiate the process by using acting surveys and procedural enquiry.

Misfortune can strike everybody, whenever. but insurance can defend you in such conditions and get better your economic losses. So if you are looking ahead to get safety from dangers related to proudly owning gold and jewelry, choose the perfect coverage quickly.

Edited By articlesworldbank

Read more

Six reasons in the back of Ramdev, Balkrishna and Patanjali's fulfillment

Six reasons in the back of Ramdev, Balkrishna and Patanjali's fulfillment

In 1995, Ramdev turned into a bit recognised yoga instructor in Haridwar whilst his close companion, Acharya Balkrishna, and him installation Divya Pharmacy - beneath the aegis of Ramdev 's guru, Swami Shankar Dev's, ashram - to make Ayurvedic and herbal drug treatments. The medicines proved so famous that Ramdev and Balkrishna sought to scale and diversify into different products. but that proved difficult considering Divya Pharmacy become registered below a agree with.

at the same time, with Ramdev's recognition hovering, sizeable finances started to are available in - giant loans from the likes of NRIs Sarwan and Sunita Poddar, in addition to locals inclusive of Govind Agarwal - which in flip helped to get bank loans. for that reason turned into born Patanjali Ayurved as a non-public business enterprise in 2006, which has since rolled out a number of products - in healthcare, hair care, dental care, toiletries, meals and extra - at breathtaking pace.