Step by step guide explaining the system of filling and submitting Form GSTR-3B.

Step by step guide explaining the system of filling and submitting Form GSTR-3B.

GST Return Filing: How To Fill GSTR-3B, Submit Form In 10 Steps

The GST Network or GSTN has come out with a step by the aid of-step guide explaining the system concerning filling and submitting Form GSTR-3B.

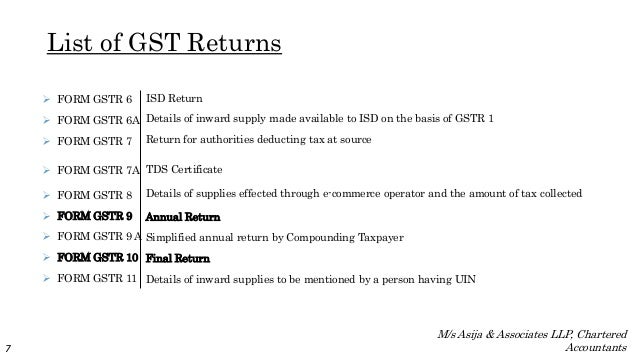

Image Source TaxGuru

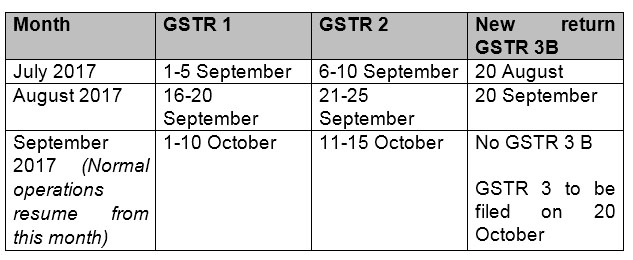

The government has extended the ultimate date for businesses to report their first returns under GST or Goods and Services Tax the use of Form GSTR-3B. The earlier deadline of August 20, for the filing of returns in opposition to July 2017, has now been extended with the aid of five days, the finance ministry said an ultimate week. Now, groups have until August 25, 2017, to submit a summary of self-assessed tax liabilities using Form GSTR-3B. The GST Network or GSTN has come out with a step-by means of-step manual explaining the technique of filling and submitting Form GSTR-3B. As per dates notified through the government, info regarding outward elements for the month of July 2017 will be filed in Form GSTR-1 among September 1 and September 5. However, within the meantime duration, businesses have to document Form GSTR-3B.

Image Source ExcelDataPro

The Form GSTR-3B will include consolidated information of outward materials and input tax credit (ITC).

The government additionally notified that August 25, 2017, closing date will even practice to taxpayers who do now not want to avail of transitional credit score in Form TRANS 1 this month. Those who need to fill up Form TRANS 1 this month, the last date can be August 28, 2017, as introduced earlier. While Form Trans 1 is to be utilized by manufacturers and offerings providers already registered underneath erstwhile critical laws earlier than GST, buyers not susceptible to be registered underneath those legal guidelines are required to use Form Trans 2.

Image Source Forbes India

The authorities also stressed on well-timed filing and “no longer watch for the last date. Suitable notification is being issued shortly.”

GSTN (Goods and Services Tax Network), which operates the GST Common Portal – gst.Gov.In, has given the subsequent hints on how to file the GST Return-3B or GSTR-3B:

Image Source CAclubindia

1. After logging in, pick ‘Return Dashboard’. After this, choose the month and monetary yr – which in this case may be July and 2017-18. Click the ‘Search’ button and choose GSTR-3B.

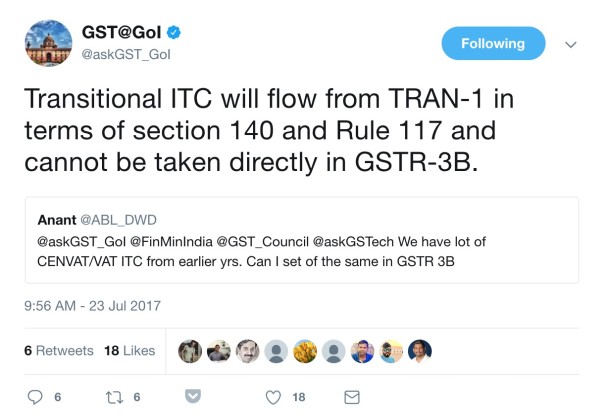

2. Declare your liabilities and ITC (enter tax credit) claims. This can be done in Section 3.1 and Section 4 and. “Transitional ITC cannot be claimed in GSTR 3B,” the GST portal noted, adding: “It may be claimed only thru TRANS 1 and TRANS 2.”

three. After this, the consumer is needed to go into info of interest, if payable. This can be filled in Section five.1. The past due to charge will be computed by way of the system, the GST portal introduced. Click the ‘Save GSTR-3B‘ button.

Image Source SlideShare

Four. After saving the entered info, a button called ‘Submit’ may be enabled. “Please observe that after publish, no change is feasible. Hence ensure that info is crammed efficaciously before clicking on Submit button,” GSTN stated at the portal.

5. After the user pushes the ‘Submit GSTR-3B button‘, the machine will “submit (debit) the self-assessed liabilities consisting of gadget generated overdue charge in Liability Register and credit score the claimed ITC into ITC ledger”.

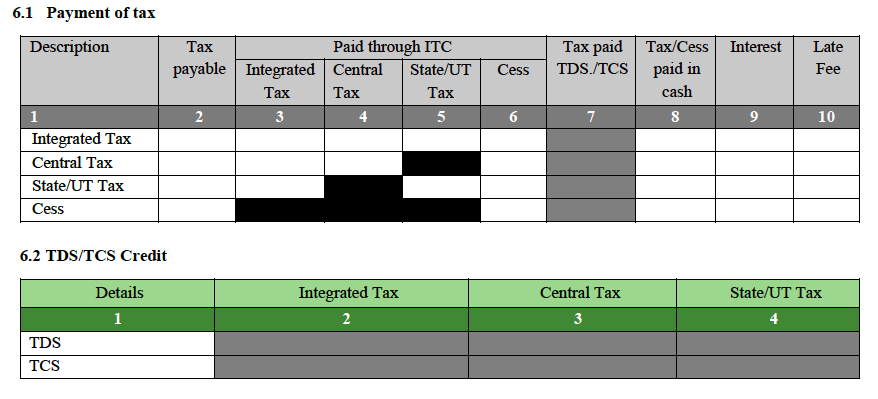

6. After this step, the Payment of Tax option (as proven in the picture) can be enabled. The consumer is required to click on on the title and claim fee info. Doing so offsets the legal responsibility.

Image Source CAclubindia

7. The person can click on at the ‘Check Balance‘ button to view the balance to be had for credit score underneath Integrated Tax, Central Tax, State Tax and Cess.

8. At this level, the consumer is needed to fill out the segment that specifies how she or he wants to set-off the liabilities. This can be accomplished by using a mixture of cash and inputs tax credit score. Among different info, the machine checks whether or not you’ve got enough coins-ITC stability and whether or not all liabilities are set-off. “Part price isn’t allowed in GSTR-3B,” the portal added.

Image Source legal raasta

9. After this step, the user can click on on the ‘Offset Liability‘ button to repay the liabilities.

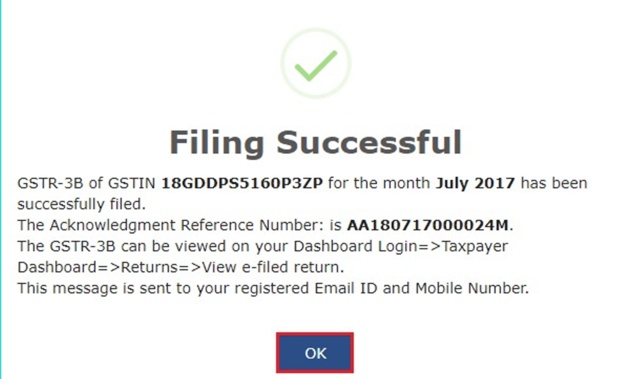

10. A statement is to be submitted through choosing the approved signatory submitting the Form GSTR-3B. Once this is performed, click the ‘File GSTR-3B’ button. “A message for a hit filing will seem and Acknowledgement will get generated,” the GSTN introduced in its manual.

Image Source KnowyourGST

Edited By articlesworldbank.com