What Is Goods and Services Tax, An Overview

What Is Goods and Services Tax, An Overview

The Goods and Services Tax (G.S.T.) is a landmark step taken via the Government of India to enhance the GDP and introduce a greater powerful tax regime.

GST is a win-win scenario for the entire country. It brings benefits to all the stakeholders of the industry, government and the purchaser. It will lower the cost of goods and offerings to present a lift to the financial system and make the goods and services globally competitive. By subsuming most of the primary and country taxes into an unmarried tax and through allowing a set-off of prior-degree taxes for the transactions across the whole feed chain, it would mitigate the sick results of cascading and enhance competitiveness and liquidity of the agencies.

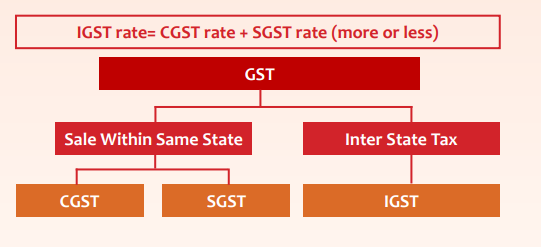

Image Source ClearIAS

GST could be applicable to all sellers whose combination turnover in a monetary 12 months exceeds INR 2.00 Million (INR 1.00 Million in case of 11 unique class states). Separate registration could be required in each kingdom from in which a taxable delivery of products or services is made.

This article covers a number of the unusual provisions of GST having an essential impact on the enterprise and gives an insightful attitude regarding the identical.

Image Source accounts4tutorials

Reverse Charge:

If the provider is not registered underneath GST and is providing taxable goods or offerings to a recipient who’s registered, the GST on such taxable elements shall be borne by means of the recipient on opposite price foundation. Meaning registration appears to be obligatory for each birthday party; else it’s miles pretty possible that due to greater compliance troubles human beings is probably inquisitive about doing commercial enterprise most effective with the one’s events who’re registered under the GST rules. With few days left with GST entering force, this registration parameter may create a large time trouble among small dealer’s as they could lose some commercial enterprise till they get registered underneath GST. Thus, on the way to counter this trouble, an economic threshold restriction in location will act as a cushion for such small business homes until the time they come completely underneath the ambit of GST compliance.

Image Source aagst

Ratings:

The authorities will supply a web rating on level, timeliness, and performance of compliances. Non-compliance will no longer just cause consequences however also blacklisting, which can have an effect on the destiny creditability, popularity and may harm the commercial enterprise boom of a commercial enterprise.

This online rating is going to be to be had at the net portal and you’ll be able to check and determine enterprise associations on the premise of these rankings.

GST on Stock Transfer:

GST is chargeable on stock transfers to depots and stockists. This will further grow the running capital requirement as the suppliers ought to incur value on the switch of goods to very own godowns and depots with none actual revenue getting gathered or realized.

The GST paid in one of these cases may be claimed as entering tax credit score on the sale of goods from depots or warehouses.

Image Source LinkedIn

Area Based Exemptions:

Under the present day tax laws North East, Uttarakhand and Himachal Pradesh have positive regions exempted from excise responsibility and other country taxes. Department of Industrial Policy and Promotion is working on a scheme in which organizations will have to pay tax in advance and may claim a refund of the identical in the areas said above. Taxes paid additionally can be claimed as prompt in opposition to any legal responsibility. The enterprise needs readability on policy and time for adjustment. It is eager on availing clean and hassles unfastened refunds.

Free of Cost Supply as Sample/Gifts/Promotional Schemes:

Free samples and gifts supplied with purchases in addition to popular ‘purchase-one-get-one-unfastened’ deals may attract GST.

GST could be totally primarily based on the concept of a ‘supply’, which now consists of even goods and/ or offerings furnished without consideration by a taxable character within the course of or furtherance of the enterprise. This will affect the income and advertising and marketing price of agencies which follow such schemes. Buyers will pay GST on articles they get hold of unfastened.

Image Source pteducation

Presently, for a unfastened sample of products, excise responsibility is payable however VAT/ CST isn’t always payable. However, proportionate input tax credit below VAT is reversible in some states. The internet impact for groups will consequently be the distinction between the prevailing excise and VAT cost, and the GST which will become payable.

Now again, the question that arises is set the goods replaced under a guarantee as those goods are again freed from cost. But, normally the vendor is charged the warranty cost at the time of delivery, that’s hidden within the very last rate of the product.

GST on Allocation of Common Expenses:

Intra-employer transactions are proposed to be taxed below GST. Any secondment of personnel, sharing of not unusual costs among related organizations would be taxed. Though the receiving entity would be entitled to avail credit of tax charged through the providing enterprise, this will result in the requirement of extra running capital for all such agencies.

Image Source gstindia

Branch Office (“BO”) and Head Office (“HO”) Transactions:

BO and HO are separate folks for the functions of GST levy. It turns into vital to decide the region of delivering of the transaction so as to decide GST implications. Should the area of delivering be in India, then as in step with Section 10 of the Integrated Goods and Service Tax (“IGST”), the transaction shall be subject to IGST beneath reverse price.

GST will be applicable wherein remote places BO is supplying to Indian HO, Indian BO offering to Indian HO and vice versa.

GST on Advance Payment:

From some bizarre provision below the GST Act, GST on strengthening payment is one. In the prevailing situation except for carrier tax, the no different law calls for to pay tax on advances. Now the taxpayer will pay GST on the advancement of products and services in GST. After giving a boost to the supplier the client will now not get the credit of GST. Whenever the dealer materials goods or services and offers the tax invoice to the receiver then best the customer will get the credit of GST. If the fees can’t be ascertained at the time of taking improve, then GST could be charged @ 18%. The money can be blocked for at some stage in this time until the delivery is finished. Similarly, the supplier will charge GST on the remaining quantity through deducting the improvement from the full amount. Every small or huge commercial enterprise will pay attention towards accounting and have to be compliant with the law. Accounting software program’s need to be upgraded to price tax primarily based on receipt invoice.

Image Source gstreadyindia

While GST is yet to come back into effect, it’s going to evolve post implementation. Further, though clarity on diverse essential troubles affecting the enterprise is nevertheless unanswered, the advantage to the economy can’t, in reality, be undermined.

For any Query or wants similar information, please in touch

offerings@rbassociates.Net

Edited By articlesworldbank.com